“Drive it ‘til the wheels fall off” isn’t the safest decision. So when does it end?

Does it feel like the cars and trucks in your repair shop keep getting older and older? Well, that’s because they are.

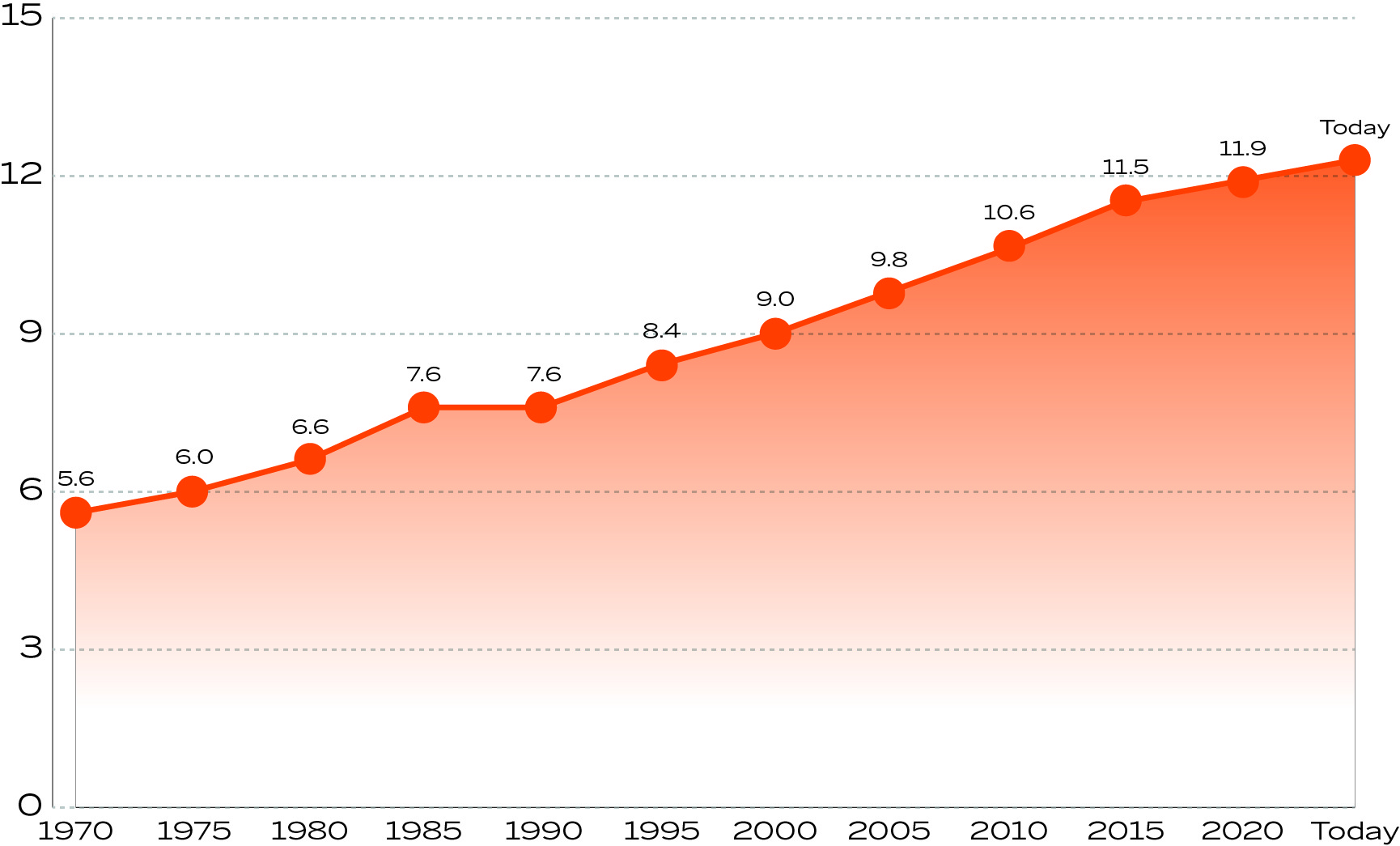

The average U.S. vehicle age is now up to 12.5 years, according to a recent analysis by S&P Global Mobility (formerly IHS Markit). That’s a new historic high, driven by drops in both supply and demand: low new vehicle supply during the pandemic, followed by rising inflation and interest rates depressing demand.

S&P also broke this number out by passenger cars and light trucks and showed that the average age of cars is climbing much more steeply than trucks. For cars, the average age is up to 13.6 years, while trucks are up to 11.8 after being mostly flat for the past decade.

The fact that people are maintaining their existing vehicles rather than buying new ones should, in theory, be good news for independent garages.

“Traditionally, the ‘sweet spot’ for aftermarket repair was considered 6-11 years of age, but with average age at 12.5 years, the sweet spot for aftermarket repair is growing,” said Todd Campau, associate director of aftermarket solutions for S&P Global Mobility, in a press release.

Sources: S&P Global Mobility, Federal Highway Administration.

This all isn’t super surprising, given everything that’s been happening in the economy, combined with the fact that average vehicles ages have been climbing for decades. Fifty years ago, your average sedan was only 5.7 years old. That number has basically increased by a year every decade since.

Recent events just accelerated those trends, with this recent uptick being the highest year-over-year jump in average vehicle age since the Great Recession in 2008 and 2009.

Of course, what matters most for indies is the number of vehicles out of warranty that represent potential customers. We followed up with S&P to see if they could provide specific numbers on how many vehicles older than 5 years are on the road today compared to the past, and will update this story with any additional statistics we can get.

Read S&P’s full press release for more details on this and other recent trends.

The articles and other content contained on this site may contain links to third party websites. By clicking them, you consent to Dorman’s Website Use Agreement.

Participation in this forum is subject to Dorman’s Website Terms & Conditions. Please read our Comment Policy before commenting.